Protect the Ones You Love

February is here — the month that celebrates love and romance and of course, Valentine’s Day. In a recent survey, Life Happens (a nonprofit life insurance organization dedicated to consumer education) found that people would much prefer their romantic partner plan for their financial future (44%) than buy them gifts (8%).1 Does this statistic surprise you?

It seems appropriate when you think about it: the motivation for buying life insurance is because you love someone, so what better time to explore your life insurance needs than February? Life insurance allows you to help protect the financial future for loved ones, and can help provide comfort during what can be a tough time for a family.

We spend our lives telling and showing our families how very much we love and appreciate them. But every year as St. Valentine’s Day rolls around, we make a special point to celebrate that love. Chocolates, flowers, a memorable dinner out on the town. All of these things can make thoughtful gifts, but they pale in comparison to giving the lasting protection a life insurance policy can provide.

If you love someone, consider life insurance

You’ve spent a life together… now you’re charting a new course. But, have you considered what would happen if you were no longer there to take care of your loved ones?

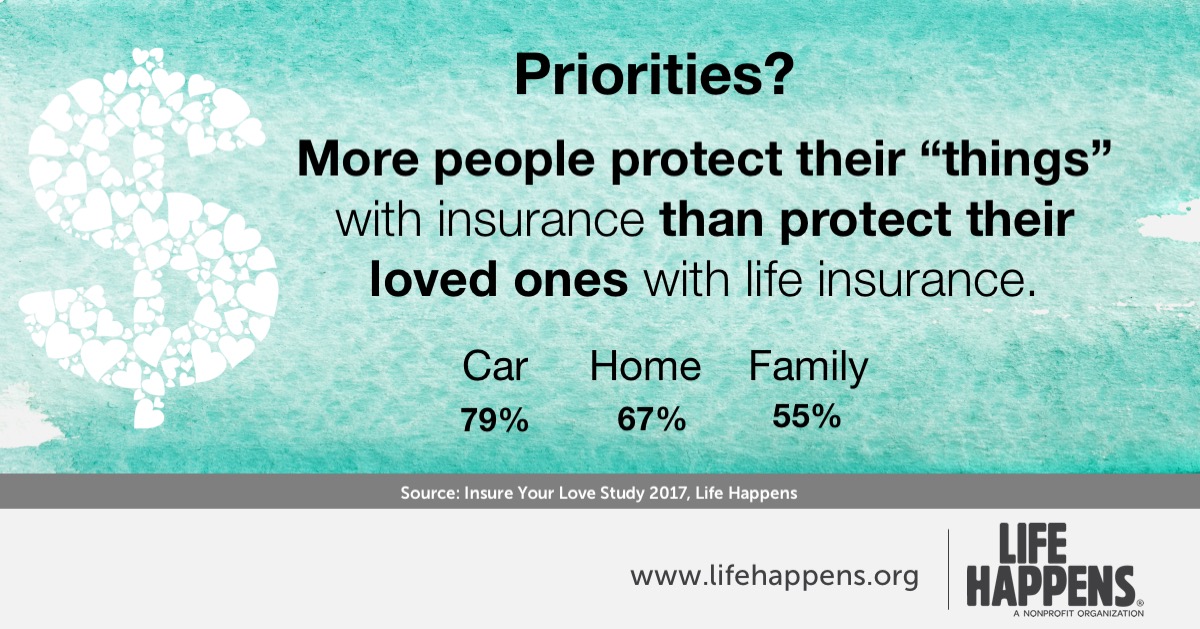

It’s simple. If people you love depend on you for their comfort and financial security, life insurance may be among the most significant purchases you’ll ever make. Life insurance can help provide for your loved ones’ financial needs after you’re gone. Whether for their families, spouses or even essential business partners, people purchase life insurance to help those they care about have more secure financial futures.

While it can be an uncomfortable thought, you buy life insurance for those you love, not for yourself. It may be hard to picture a day when you might not be there to take care of your loved ones, but life insurance is designed to do just that: help take care of the ones you love in the event you no longer can. Life insurance proceeds provide money directly to your beneficiaries, to help your family pay bills, fund a child’s education, protect a spouse’s retirement or assist aging parents if you’re no longer able to care for them.

While nothing can replace you, having life insurance means that if something happened to you, your loved ones would be okay financially. Protect the ones you love with life insurance. Be sure to contact your financial professional today to discuss your options and coverage.

Information for this article was provided by Life Happens, a nonprofit organization dedicated to helping consumers make smart insurance decisions to safeguard their families’ financial futures: www.lifehappens.org.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments or products may be appropriate for you, consult with your financial professional.

Guarantees are backed by the financial strength and claims paying ability of the issuing company.

Sources:

1“Study: What Do Romantic Partners Want?” Life Happens, 2018

The post Protect the Ones You Love appeared first on Adult Financial Education Services.

Source: Adult Financial Education

Protect the Ones You Love

Comments are closed.